USD Coin, commonly known as USDC, is one of the leading stablecoins in the cryptocurrency world, designed to maintain a stable 1:1 peg with the US dollar. But how exactly does USD Coin hold this peg consistently in a volatile crypto environment? This article breaks down what USD Coin is, how it backs every token with real US dollars and equivalent assets, and the mechanisms and safeguards it uses to maintain confidence and stability. Whether you're curious about stablecoins or deciding where to store your digital assets—like a trusted usdt wallet or the best usdt wallet options including usdt wallet coinbase—understanding USDC's peg strategy is key.

What Is USD Coin?An Introduction to USDC

How USDC Works on Blockchain

USD Coin is a stable digital currency fully backed by US dollars, issued by regulated entities under Circle’s management. Each USDC token is redeemable for one US dollar, making it a stable alternative to highly volatile cryptocurrencies like Bitcoin or Ethereum. Launched in 2018, USDC operates across multiple blockchain networks—such as Ethereum, Solana, and Algorand—allowing rapid and low-cost transactions worldwide, anytime.

USDC’s design leverages blockchain technology to provide transparency, immutability, and security, while the 1:1 peg to the US dollar ensures users avoid the price swings common in other crypto assets. This stablecoin is widely accepted across crypto exchanges, decentralized finance (DeFi) platforms, and payment systems, making it a versatile digital dollar.

Understanding USDC’s 1:1 Dollar PegCollateralization with Real-World Assets

Mechanisms Keeping the Peg Stable

At the heart of USDC’s stability is its full collateralization. For every USDC token in circulation, an equivalent amount of US dollars, or liquid cash-equivalents, are held in regulated reserve accounts.

These reserves aren’t simply stored as cash; a significant portion is invested in secure, highly liquid instruments like short-term US Treasury bills and money market funds. This conservative reserve composition helps protect against market fluctuations and allows USDC to maintain its 1:1 redeemability.

USDC issuers regularly mint (create) new tokens only when fiat currency is deposited, and redeem (burn) tokens when holders convert USDC back to fiat. This mint-and-burn process ensures supply and demand remain tightly coupled, preventing price deviations.

Transparency and Regulatory ComplianceMonthly Audits and Public Reserve Reports

Licenses and Legal Oversight

One of the strongest assurances behind USDC’s stability is its commitment to full transparency and regulatory compliance. Circle, the primary issuer of USDC, publishes monthly attestation reports from top accounting firms verifying that reserves meet or exceed circulating token value.

These audits, publicly accessible, offer users and regulators confidence that the digital coins are truly backed by real assets. Additionally, Circle operates under multiple financial licenses across states and countries, adhering to Anti-Money Laundering (AML) and Know Your Customer (KYC) rules to maintain regulated “stored value” status.

USDC’s Use Across Different Blockchain NetworksMulti-Chain Availability

Benefits of Cross-Chain Interoperability

USDC is natively issued on numerous blockchains, including Ethereum, Solana, Avalanche, and others. This multi-chain presence increases accessibility and enables users to transact USDC across various decentralized applications and exchanges seamlessly.

The Cross-Chain Transfer Protocol (CCTP) facilitates secure, smooth transfers of USDC between these different blockchains by burning tokens on one chain and minting them on another, maintaining the overall supply balance and peg integrity.

The Role of USDC in Everyday Crypto UsageSafe Storage Options: Choosing the Best USDT Wallet

USDC vs. USDT and Wallet Compatibility

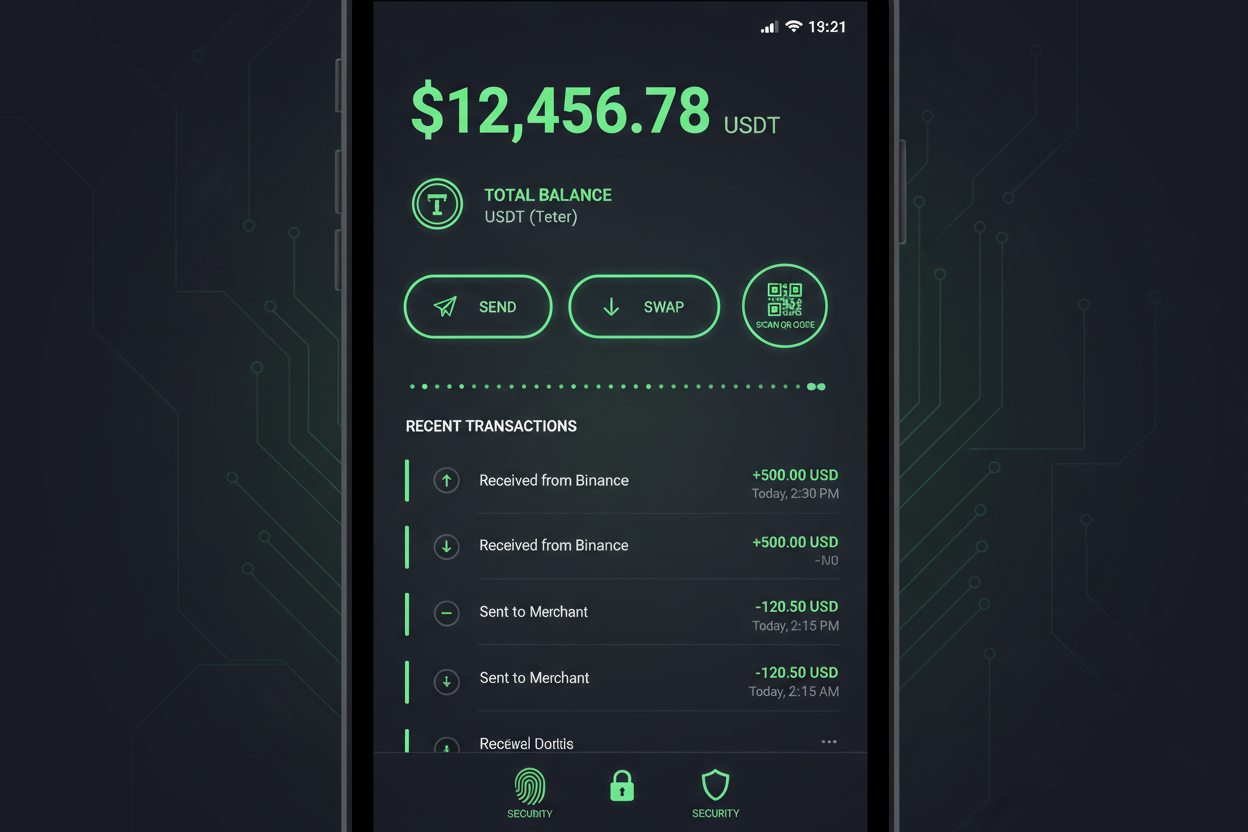

Just as important as understanding USDC technology is managing it securely. Many users seek a reliable usdt wallet or best usdt wallet to hold their stablecoins safely, since digital assets require secure custody. Popular platforms like Coinbase offer an integrated usdt wallet Coinbase users can trust for secure storage and easy access.

While USDT (Tether) remains the highest volume stablecoin, USDC’s regulatory compliance and transparency often make it the preferred choice for institutions and individuals who prioritize trust and auditability. Many wallets and exchanges support both, allowing users flexibility when transferring or trading stablecoins.

Common Questions About USDC StabilityHow Does USDC Compare to Other Stablecoins?

Can USDC Price Deviate from $1?

USDC differs from algorithmic and crypto-backed stablecoins by maintaining a fully backed reserve system, which is why its price stability is generally stronger. While slight, momentary fluctuations around $1 can occur due to market demand and trading activity, they rarely deviate significantly because of the underlying fiat reserves and redemption guarantee.

If the peg ever threatens to break, arbitrage opportunities arise. Traders can buy or redeem USDC at a discount or premium, which helps realign USDC’s market price with the dollar, a dynamic that has historically maintained its peg effectively.

How Can You Get and Use USD Coin?Converting Fiat to USDC

Spending, Sending, and Receiving USDC

USDC can be easily purchased on many cryptocurrency exchanges by depositing fiat currency and converting it into digital tokens. Trusted platforms offer easy onboarding, often supporting various fiat methods—from bank transfers to cards.

Once acquired, USDC can be sent across borders almost instantly, used in payments, integrated with DeFi protocols, or traded on exchanges. Its stable value enables wide adoption for remittances, online shopping, and treasury management.

Summary: Why USD Coin Maintains Its Stable Dollar Peg

USD Coin (USDC) maintains its stable 1:1 peg to the US dollar primarily through fully backed reserves held in low-risk, liquid assets, combined with transparent audits and strict regulatory compliance. These factors, along with worldwide blockchain availability and a robust mint-and-burn mechanism, enable USDC to offer stability, security, and utility. Whether you're exploring the best usdt wallet for your assets or using an usdt wallet Coinbase supports, USDC represents a trustworthy digital dollar option in the growing stablecoin ecosystem.

To learn more about USD Coin and explore how to safely buy, store, and use this digital dollar, visit trusted crypto exchanges and wallets today.